net investment income tax 2021 calculator

Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. Long-term capital gains are gains on assets you hold for more than one year.

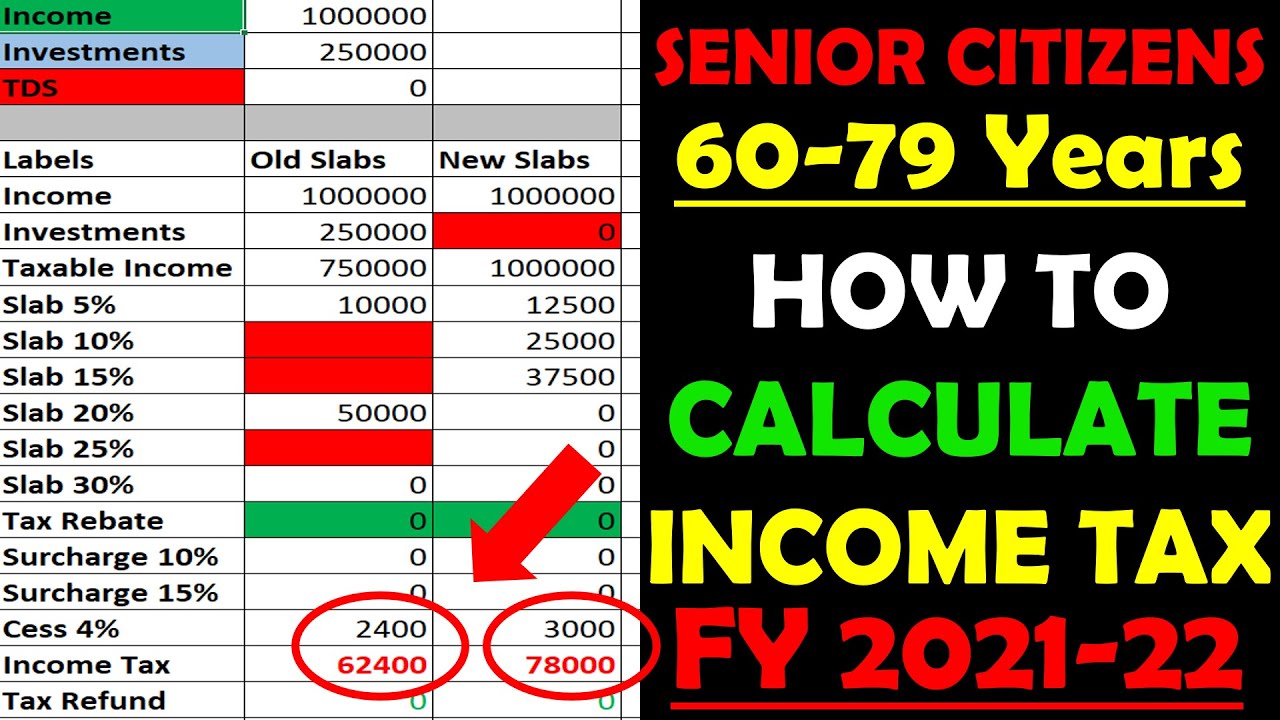

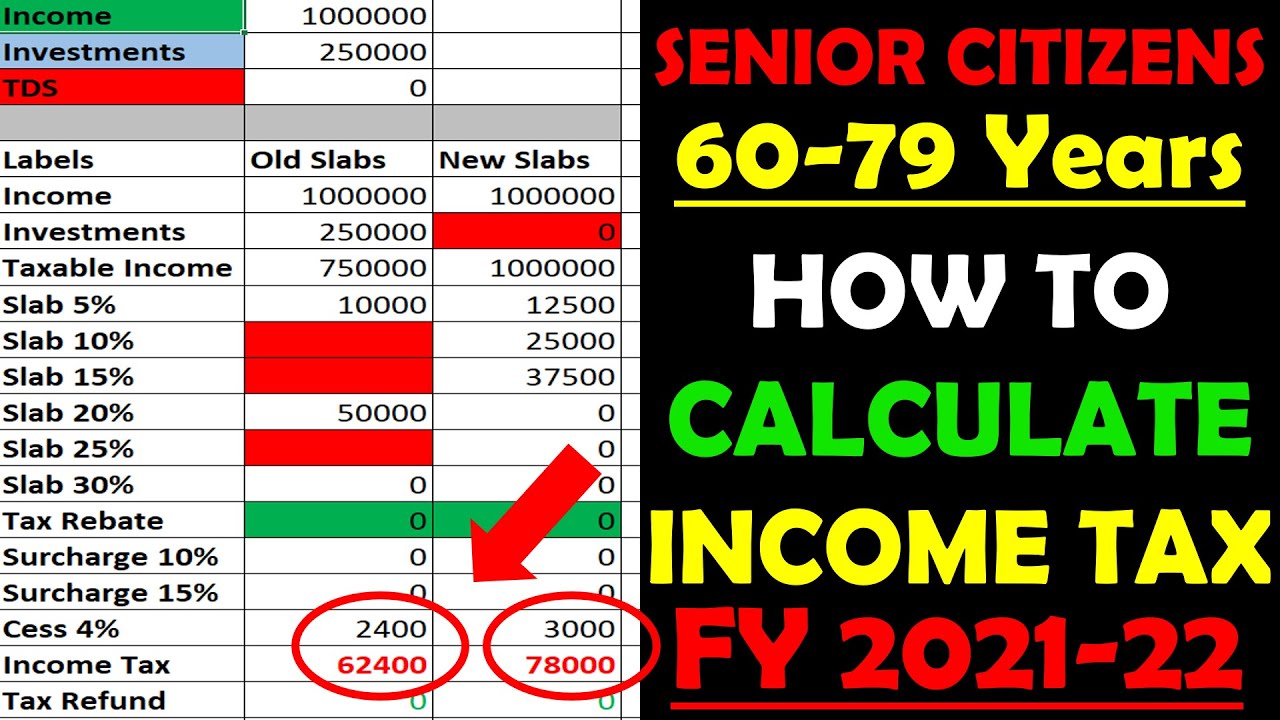

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

Distribution Dates and Amounts Announced for Eaton Vance Closed-End Funds and Portfolio Managers of Eaton Have High Income 2021 Target Term Trust NYSE.

. Heres the math we used to calculate that tax payment. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. 5000 x 22 1100.

Investment Tax Calculator. This income tax calculator or net salary calculator or take home pay calculator is a simple wages calculator displaying a list of already calculated net salary after tax for each possible salary level in the UK. In 2021 the tax credit was up to a 3600 per child under age six and up to 3000 per child age six to 17.

The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable assets. You can include your income Capital Gains Overseas Pensions Donations to charity and allowances for family members. The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the 2022 Tax Assessment year 1 st January 2022 - 31 st December 2022.

The federal estate tax return has to be filed in the IRS Form 1041 the US. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Get 105 of your premium back 3 or get monthly income from age 60 on survivalmaturity.

The tax explained. Income Tax Return for Estates and Trusts. Uncover the hidden tax benefits related to rental property ownership.

Get claim payout on diagnosis of 64 critical illnesses 4 optional. Salary after tax and national insurance contribution is calculated correctly by assuming that you are younger than 65 not married and with no pension deductions no. LITO and LMITO effectively allows you to earn up to 21884 in the 2022-23 financial year before any income tax is payable.

Income Tax calculator is a Free Tax Calculator that helps you in calculating Income Tax based on your Income. After-tax income is your total income net of federal tax provincial tax and payroll tax. Income Tax Calculator - Calculate Income Tax Online for FY 2020-21 AY 2021-22 with Canara HSBC Life Insurance.

For example if you earn 109000 pa. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison. Use this 1040 tax calculator to help estimate your tax bill for the current tax years rates and rules.

Income Tax Calculation Example. Rates are up to date as of June 22 2021. This Pages Content Was Last Updated.

For tax audit cases the deadline has been extended to 30th November 2021. These calculations are approximate and include the following non-refundable tax credits. In 2021-21 that amount was 24674.

How your Adjusted Net Income can affect your tax. Rental income is taxed as ordinary income. Tax benefit 6 as per prevailing tax laws.

Statutory contributions such as Philhealth SSS GSIS and Pag-IBIG have their own computation set by the respective agencies and will still be deducted from the employees monthly salary. In the view of the coronavirus pandemic the Income Tax Department has extended the deadline for filing ITR for taxpayers not covered under audit for the financial year 2020-21 till September 30 2021. Closed-End Fund Earnings Undistributed Net Income.

1800-258-5899 9 am to 6 pm. In FY 2022-23 there are 2 tax regimes Old and New. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

Income Tax Calculation 2021-22 Video. Use our income tax calculator know your tax liability. It is mainly intended for residents of the US.

That means you pay the same tax rates you pay on federal income tax. For tax year 2021 the standard tax deductions are. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified adjusted gross income exceeds the taxs thresholds.

Theyre taxed like regular income. EHT - Last. Historical Returns as of Jun 30 2022.

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for that. If your Income is Rs.

Total net investment losses eg. TDS TCS advance tax tax relief under section 87A9090A91 tax credit AMT MAT. Any amount on which family trust distribution tax has been paid.

For transfer pricing cases the due date has been extended to 31st December. And is based on the tax brackets of 2021 and 2022. Accidental death benefit 5 cover up to 2 crore optional.

Ensure right life cover1 to protect yourself adequately at every life-stage 2. 5 Comments Calculators Budget Budget 2020 Income tax Investment Plan Taxes By Amit August 1 2021 August 2. The above calculator provides for interest calculation as per Income-tax Act.

Note that this amount is significantly lower than 2021. How Gross Income and Net Income Can Affect Your Budget. One of the two options will reduce your taxable income more than the other.

We have below investment options to save income tax under Section 80C. Theyre taxed at lower rates than short-term capital gains. Which includes 9000 of superannuation then your salary package is worth 109000 your gross income is 100000 your tax withheld would be around 26000 and your net income would be around 74000.

If were born before the 6th of April 1938 and had an adjusted net income of over 27700 during the tax year of 2015 to 2016 then you become liable to the income-related reduction to. The CPP Investment Board then invests CPP funds. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020.

Income Tax Calculator for 2021 2022. This means that if an investor is in a 22 marginal tax bracket and their rental income is 5000 the investor would end up paying 1100. Now calculate the total tax payable on such net taxable income.

Capital Gains Tax Calculator. You can also refer to Scripboxs Income Tax Calculator to calculate the total tax payable on income earned. Its important to know your adjusted net income because if it goes over a certain threshold it can affect you.

Try SuperGuides income tax calculator to understand the offsets and. See how much NIIT you owe by completing Form 8960. The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return.

Self-assessment tax will be total tax payable minus taxes already paid ie. Find out your tax brackets and how much Federal and Provincial taxes you will pay. Figures shown by the calculator are based on the tax reforms tax schedule for 2017 2018 and 2019 including deductible exemptions and contributions.

Download the Excel based Income Tax Calculator India for FY 2021-22 AY 2022-23. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low. A 1000 deduction can only reduce net taxable income by.

Investment income is subject to the Net Investment Income Tax NIIT. For people with net taxable income below Rs 5 lakh the tax rebate has been increased from Rs 2000 to Rs 5000 us 87A. This number is called the Net Income Tax Liability.

How To Calculate Income Tax Fy 2021 22 Excel Examples Senior Citizens Age 60 To 79 Years Youtube

Easy Net Investment Income Tax Calculator

Capital Gains Tax Calculator 2022 Casaplorer

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

How To Calculate Additional Medicare Tax Properly

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Net Profit Margin Calculator Bdc Ca

Canada Capital Gains Tax Calculator 2022

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

Effective Tax Rate Formula And Calculation Example

Net Operating Profit After Tax Calculator Efinancemanagement

Tax Calculator Estimate Your Income Tax For 2022 Free

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2021 2022 Income Tax Calculator Canada Wowa Ca

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

What Is The The Net Investment Income Tax Niit Forbes Advisor